UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

| | |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

|

|

| ELI LILLY AND COMPANY |

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| | | | |

| Payment of Filing Fee (Check the appropriate box): |

| | | | | |

| x | | No fee required. |

| | | |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | | | |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | | | |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | | | |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | | | |

| | | (5) | | Total fee paid: |

| | | | | |

| | | | | |

| o | | Fee paid previously with preliminary materials. |

| | | | | |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | | |

| | | (1) | | Amount Previously Paid: |

| | | | | |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | | | |

| | | (3) | | Filing Party: |

| | | | | |

| | | (4) | | Date Filed: |

| | | | | |

|

| |

| SEC 1913 (11-01) | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

Notice of 20142017 Annual Meeting of Shareholders and Proxy Statement

Your vote is important

Please vote by using the Internet, telephone, or by signing, dating, and returning the enclosed proxy card.card by mail.

Table of Contents

|

| | |

| 38 |

|

| 47 |

|

| 48 |

|

| 48 |

|

Item 2. Proposal to Ratify Appointment of Independent Auditor; Audit Committee Report | 49 |

|

| 51 |

|

|

| 52 |

|

| 54 |

|

| 55 |

|

|

| 57 |

|

Notice of 2017 Annual Meeting of Shareholders

To the holders of Common Stock of Eli Lilly and Company:The 20142017 Annual Meeting of Shareholders of Eli Lilly and Company will be held as shown below:

|

| | |

| ● | WHEN:TIME AND DATE: | 11:00 a.m. EDT, Monday, May 5, 20141, 2017 |

| ● | WHERE:LOCATION: | The Lilly Center Auditorium Lilly Corporate Center Indianapolis, Indiana 46285 |

| | |

| | |

| ● | ITEMS OF BUSINESS: | Election of the five directors listed in the proxy statement to serve three-year terms |

| | | Ratification of Ernst & Young LLP as the principal independent auditors for 2014 |

| | Approval, by non-binding vote, of the compensation paid to the company's named executive officers |

| | Advisory vote regarding the frequency of future advisory votes on named executive officer compensation |

| | Ratification of Ernst & Young LLP as the principal independent auditors for 2017 |

| | Proposal to amend the Lilly Directors' Deferral Plan |

| | Shareholder proposal seeking report regarding direct and indirect political contributions |

| ● | WHO CAN VOTE: | Shareholders of record at the close of business on February 28, 201424, 2017 |

This proxy statement is dated March 20, 2017, and is first being sent or given to our shareholders on or about the date.

See the back page of this report for information regarding how to attend the meeting. Every shareholder vote is important. If you are unable to attend the meeting in person, please sign, date, and return your proxy and/or voting instructions by mail, telephone or through the Internet promptly so that a quorum may be represented at the meeting.

By order of the Board of Directors,

James B. LootensBronwen L. Mantlo

Secretary

March 24, 201420, 2017

Indianapolis, Indiana

Important notice regarding the availability of proxy materials for the shareholder meeting to be held May 5, 2014:1, 2017: The annual report and proxy statement are available at http:https://www.lilly.com/pdf/lillyar2013.pdfannualreport2016.

Proxy Statement OverviewSummary

General Information

This overviewsummary highlights information contained elsewhere in this proxy statement. It does not contain all the information you should consider, and you should read the entire proxy statement carefully before voting.

|

| | | |

| Meeting: | Annual Meeting of Shareholders | Date: | May 5, 20141, 2017 |

| Time: | 11:00 a.m. EDT | Location: | The Lilly Center Auditorium Lilly Corporate Center Indianapolis, Indiana 46285 |

| Record Date: | February 28, 201424, 2017 | |

| Items of Business: | Item 1: Election of the five directors listed in this proxy statement to serve three-year terms. |

| | Item 2: Approval, by non-binding vote, of the compensation paid to the company's named executive officers. |

| Item 3: Advisory vote regarding the frequency of future advisory votes on named executive officer compensation. |

| Item 4: Ratification of Ernst & Young LLP as the principal independent auditor for 2017. |

| Item 5: Proposal to amend the Lilly Directors' Deferral Plan. |

| Item 6: Shareholder proposal seeking report regarding direct and indirect political contributions. |

What Is New In This Year's Proxy Statement

BelowWe refined the Shareholder Value Award (SVA), one of the equity compensation programs for our executive officers, to include a Total Shareholder Return (TSR) modifier. The number of shares to be awarded under the SVA will increase or decrease by 1 percent for every percentage point that Lilly's three-year TSR deviates from our peer group's median three-year TSR (capped at +/-20 percent). This change rewards our executive officers for delivering top performance within the industry and increasing shareholder return. Executive officers received a larger portion of their total equity as SVAs (from 50 percent to 60 percent) to incentivize behavior that is a summary of changes to our compensation disclosures since our proxy filing last year, based on dialoguealigned with shareholders:long-term growth.

In December 2016, John C. Lechleiter, Ph.D., retired as President and CEO. David A. Ricks became President and CEO, and a member of the Board of Directors, on January 1, 2017. Dr. Lechleiter will serve as non-executive chairman until May 31, 2017. On June 1, 2017, Mr. Ricks will succeed him as Chairman.

In October 2016, we welcomed Jamere Jackson to the board. Mr. Jackson is CFO of Nielsen Holdings plc.

In February 2017, we welcomed Carolyn R. Bertozzi, Ph.D., to the board. Dr. Bertozzi is the Anne T. and Robert M. Bass Professor of Chemistry and Professor of Chemical and Systems Biology and Radiology at Stanford University. She is an investigator for the Howard Hughes Medical Institute.

In 2017, the board approved an annual compensation cap of $800,000 for non-employee directors, which is reflected in the provisions of the amended Directors' Deferral Plan (see Item 5).

Highlights of 2016 Company Performance

The following provides a brief look at our 2016 performance in three dimensions: operating performance, innovation progress, and shareholder return. See our 2016 annual report on Form 10-K for more details.

Operating Performance

Performance highlights:

2016 revenue increased 6 percent to approximately $21.2 billion.

2016 earnings per share (EPS) increased 14 percent on a reported basis to $2.58, and increased 3 percent on a non-GAAP basis to $3.52.

*A reconciliation of GAAP and externally reported non-GAAP measures is included in Appendix A.

Innovation Progress

We made significant advances with our pipeline in 2016, including:

U.S. approval of a new cardiovascular (CV) indication for Jardiance®(empagliflozin) tablets and an EU label update to include a change to the indication statement regarding the reduction of risk of CV death in adults with type 2 diabetes and established CV disease.

| |

1.• | We redesigned our proxy statement to make it easierU.S. approval and conditional EU approval for our shareholders and other stakeholders to understand our compensation programs and to highlight important information about our corporate governance and other company practices.LartruvoTM (olaratumab) for soft tissue sarcoma. |

| |

2. | We expanded our compensation recovery policy to cover all executives and to encompass a broader range of executive misconduct. |

| |

3. | We reassessed our peer group in 2012 and expanded it to include six smaller biopharmaceutical and medical device companies: Allergan, Inc.; Biogen IDEC Inc., Celgene Corporation, Covidien PLC, Gilead Sciences, Inc., and Medtronic, Inc. We selected a revised peer group that would place Lilly in the middle of the group in terms of revenue. |

U.S., EU, and Japan approval for Taltz® (ixekizumab) for moderate-to-severe plaque psoriasis.

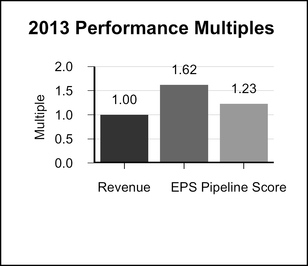

2013 Business Performance Highlights

2013 fallsMultiple new indications in the middle of what we call the "YZ" period, during which we lose patent protectionEU and Japan for a number of important products, including Zyprexa in the U.S. and Europe in late 2011, Cymbalta in the U.S. in December 2013, and Evista in the U.S. in March 2014. Despite these challenges, we delivered on our financial commitments for 2013, with revenue increasing 2 percent to $23.1 billion, non-GAAP net income increasing 19 percent to $4.5 billion, and non-GAAP earnings per share increasing 22 percent to $4.15. Total operating expenses decreased 1 percent, even as we continued to advance the company's pipeline. Reported net income for 2013 increased 15 percent to $4.68 billion, and reported earnings per share increased 18 percent to $4.32. (See Appendix A for a more detailed summary of adjustments to EPS.) Further information on our financial performance during 2013 is available in our 2013 Form 10-K and fourth-quarter earnings release available on our website at http://investor.lilly.com/financials.cfm. Cyramza.

Shareholder Return

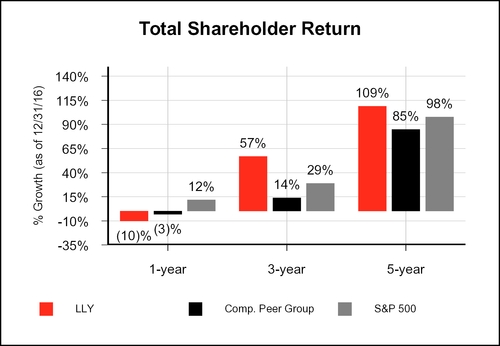

We also made significant progressgenerated strong TSR (share price appreciation plus dividends, reinvested quarterly) for the three- and five-year periods through year-end 2016. Our returns exceeded both the compensation peer group and the S&P 500 in deliveringthe three- and five-year periods, but lagged for the one-year period that ended on the pipeline, with regulatory submissions for four products – empagliflozin, dulaglutide, new insulin glargine, and ramucirumab – along with five other new indication or line extension ("NILEX") approvals during 2013. In addition to these submissions, as of March 1, 2014, we also had 12 molecules in Phase III or submission stage and 25 more in Phase II.December 31, 2016:

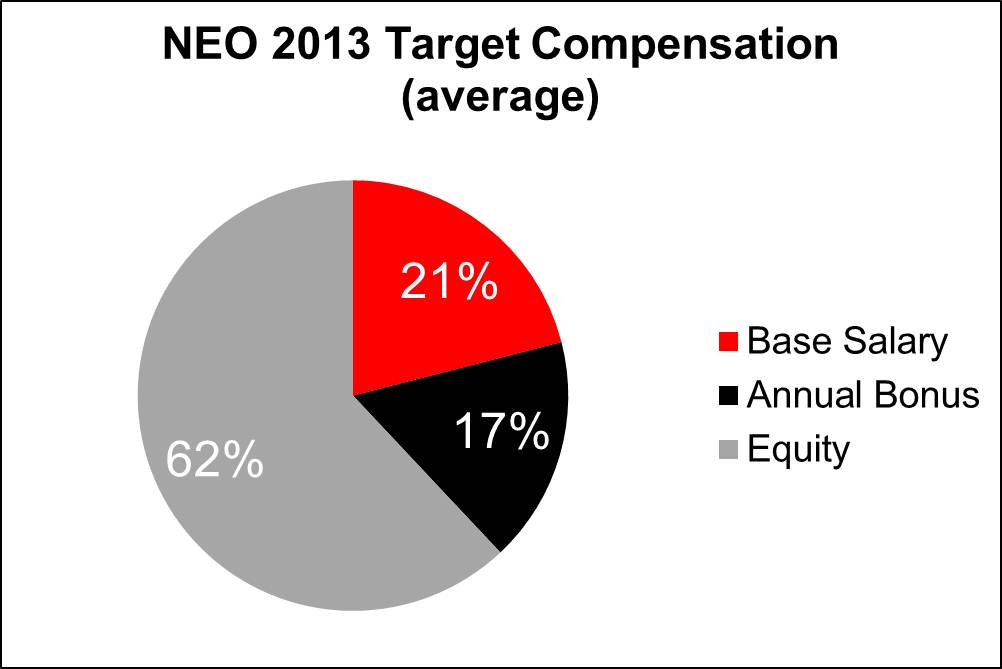

Executive Compensation Summary for 2013

Under the leadership of our chairman and chief executive officer (CEO), Dr. John Lechleiter, during the past five years the company has made significant strides in advancing the pipeline, as illustrated by the figures below:

|

| | | |

| | Phase II NMEs | Phase III NMEs | Regulatory Submissions |

| 2008 | 10 | 5 | 2 |

| | | | |

| | ò | ò | ò |

| | | | |

| 2013 | 25 | 8 | 7* |

* Representing four products.

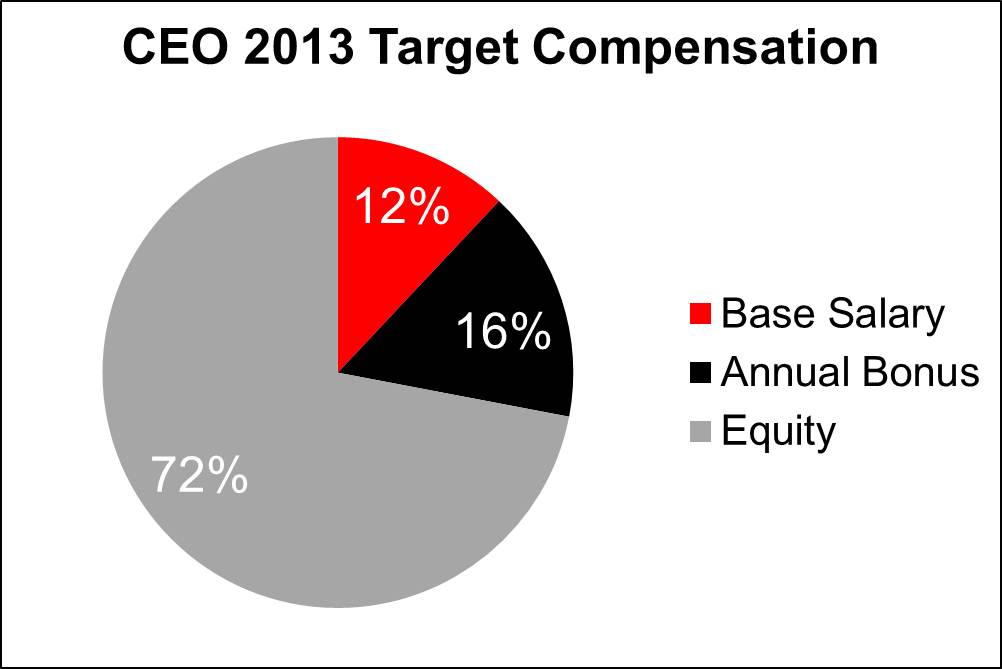

Prior to 2013, Dr. Lechleiter had not received an increase in target compensation since 2009. For 2013, the Compensation Committee decided to increase Dr. Lechleiter's target equity compensation based on the following factors:

Dr. Lechleiter's continued strong performance in leading the company during a difficult period of patent expirations to achieve solid financial results, reduce its cost structure, and progress the pipeline

The company's strong 2012 financial performance compared to goals; and

Peer group CEO pay trends as well as internal pay relativity compared to his direct reports

In keeping with the company's desire to maintain the substantial majority of the CEO's pay long-term focused and linked to company performance and shareholder value, the Compensation Committee only increased

Dr. Lechleiter's target equity compensation. Dr. Lechleiter's base salary and annual bonus targets remained unchanged.

The named executive officers each received base salary increases of between 2 and 3 percent, excluding

Mr. Harrington, who was promoted to Senior Vice President and General Counsel on January 1, 2013. These increases were consistent with those granted to other U.S. employees who were eligible for salary increases. The total compensation paid to the company's named executive officers in 2012 remained in the middle range of the updated peer group. As a result, the committee made no changes to target equity compensation for the other named executive officers for 2013, except for Mr. Harrington, as noted above.

Further information on executive compensation for 2013 can be found in the "Compensation Discussion and Analysis" and "Executive Compensation" sections below.

Voting Proposals

Shareholders will vote on the following items at the annual meeting:

|

| | | | | | |

Agenda

Item | Management

recommendation | Vote required to pass |

| Item 1 | Elect the following nominees for director to serve a three-year term that will expire in 2017: | Vote FOR all | Majority of

votes cast |

| Name and principal occupation | Joined the Board | Age | Public boards | | |

| | | | | | |

| Michael L. Eskew | 2008 | 64 | 3M Corp. | Vote FOR | |

| Former Chairman and CEO - UPS | IBM Corp. |

| UPS, Inc. | |

| | | | | | | |

| Karen N. Horn, Ph.D. | 1987 | 70 | T. Rowe Price Mutual Funds | Vote FOR | |

| Retired President, Private Client Services, and Managing Director - Marsh, Inc. | Simon Property Group, Inc. |

| Norfolk Southern Corp. |

| | | | | | | |

| William G. Kaelin, Jr. | 2012 | 56 | None | Vote FOR | |

| Professor, Department of Medicine and Associate Director, Basic Science - Dana-Farber/ Harvard Cancer Center | |

| | | | | | | |

| John C. Lechleiter, Ph.D. | 2005 | 60 | Nike, Inc. | Vote FOR | |

| Chairman, President, and CEO - Eli Lilly and Company | Ford Motor Company | |

| | | | | | | |

| Marschall S. Runge | 2013 | 59 | None | Vote FOR | |

| Executive Dean for the School of Medicine at the University of North Carolina at Chapel Hill | |

| | | | | | | |

| Item 2 | Ratify the appointment of Ernst & Young LLP as the company's principal independent auditor for 2014. | Vote FOR | Majority of

votes cast |

| Item 3 | Approve, by non-binding vote, compensation paid to the company's named executive officers. | Vote FOR | Majority of

votes cast |

|

| |

Our Corporate Governance Policies Reflect Best Practices | Further Information |

ŸItem 1: Election of Directors | See page 9 |

|

| | | | | |

| Name and principal occupation | Public boards | Management recommendation | Vote required to pass

|

| Michael L. Eskew, 67 | 3M Corporation; IBM Corporation; Allstate Insurance Company | Vote FOR | Majority of votes cast |

| Former Chairman and Chief Executive Officer, United Parcel Service, Inc. |

| Director since 2008 | | |

| | | |

| | | |

| | | |

| William G. Kaelin, Jr., M.D., 59 | | Vote FOR | Majority of votes cast |

| Professor, Dana-Farber Cancer Institute; Associate Director, Dana-Farber/Harvard Cancer Center |

| Director since 2012 | | |

| | | |

| | | |

| | | |

| John C. Lechleiter, Ph.D., 63 | Ford Motor Company; Nike, Inc. | Vote FOR | Majority of votes cast |

Chairman of the Board, Eli Lilly and Company

|

| Director since 2005 | | |

| Retirement on May 31, 2017 | | | |

| | | |

| | | |

| David A. Ricks, 49 |

| Vote FOR | Majority of votes cast |

| President and Chief Executive Officer, Eli Lilly and Company |

| Director since 2017 | | |

| Chairman, effective June 1, 2017 | | |

| | |

| | | |

| Marshall S.Runge, M.D., Ph.D., 62 | | Vote FOR | Majority of votes cast |

| Executive Vice President for Medical Affairs, University of Michigan |

| Director since 2013 | | |

| | | |

| | | |

| | | |

Our Corporate Governance Policies Reflect Best Practices

| |

| ü | Our board membership is marked by leadership, experience, and diversitydiversity. |

| |

Ÿü | All 15 of our nonemployeenon-employee directors, and all board committee members, are independent, with the exception of Dr. John Lechleiter, our former President and CEO. Dr. Lechleiter will retire in May 2017. |

| |

Ÿü | Strong,We have a strong, independent lead director rolerole. |

| |

Ÿü | AllOur board committees are fully independent |

Ÿ | Executive sessions are held at every regularly-scheduled board meeting |

Ÿ | Active board participationactively participates in company strategy and CEOCEO/senior executive succession planning, most recently with respect to our new President and CEO. |

| |

Ÿü | Board oversight ofOur board oversees compliance and enterprise risk management practicespractices. |

| |

Ÿü | Meaningful directorWe have in place meaningful stock ownership guidelinesrequirements. |

| |

Ÿü | MajorityWe have a majority voting standard and resignation policy for the election of directorsdirectors. |

|

| |

| Compensation | Further Information |

Item 2: Advisory Vote on Compensation Paid to Named Executive Officers | See page 33 |

|

| |

Our Executive Compensation Programs Reflect Best Practices | | | | |

Ÿ | Strong | | | | Management recommendation | Vote required to pass

|

| Item 2 | Approve, by non-binding vote, compensation paid to the company's named executive officers

| Vote FOR | Majority of

votes cast |

Our Executive Compensation Programs Reflect Best Practices

| |

| ü | We have had strong shareholder support of compensation practices: in 2013, 972016, over 98 percent of shares cast voted in favor of our executive compensationcompensation. |

| |

Ÿü | CompensationOur compensation programs are designed to align with shareholder interests and link pay to performance through a blend of short- and long-term performance measuresmeasures. |

| |

Ÿü | TheOur Compensation Committee annually reviews compensation programs to ensure appropriate risk mitigationthey provide incentives to deliver long-term, sustainable business results while discouraging excessive risk-taking or other adverse behaviors. |

| |

Ÿü | NoWe have a broad compensation recovery policy that applies to all executives and covers a wide range of misconduct. |

| |

| ü | Our executive officers (EOs) are subject to robust stock ownership guidelines and are prohibited from hedging or pledging their company stock. |

| |

| ü | We do not have "top hat" retirement plans - plans—supplemental plans are open to all employees and are limited to restoring benefits lost due to IRS limits on qualified plansplans. |

| |

Ÿü | Broad compensation recovery policy that applies to all executives and covers a wide range of misconduct |

Ÿ | Executives and senior management are prohibited from engaging in hedging transactions with company stock or pledging their company stock |

Ÿ | Executives are subject to strong stock ownership guidelines |

Ÿ | NoWe do not provide tax gross-ups provided to executivesEOs (except for limited gross-ups related to international assignments). |

| |

Ÿü | Very limited perquisites; CEO did not use the corporate aircraft for personal use at any time during 2013. Other named executive officers (NEOs) are not permitted to use the corporate aircraft for personal useWe have a very restrictive policy on perquisites. |

| |

Ÿü | SeveranceOur severance plans related to change-in-control generally require a double triggertrigger. |

| |

Ÿü | NoWe do not have employment agreements with any of our EOs. |

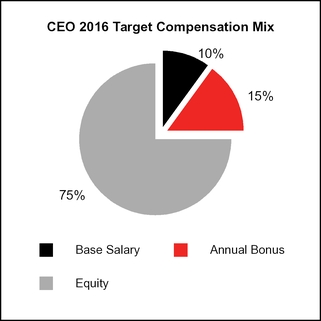

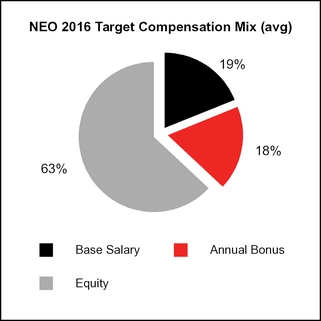

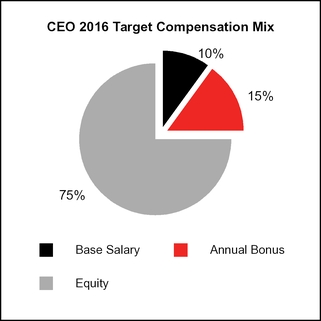

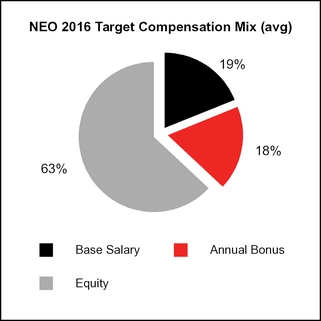

Executive Compensation Summary for 2016

At the time the total target compensation was established at the end of 2015, compensation for our named executive officers (the five officers whose compensation is disclosed in this proxy statement) was in the middle range of the company's peer group. Incentive compensation programs paid out above target, consistent with the company's strong performance in 2016, as outlined below under "Pay for Performance."

Pay for Performance

As described more fully in the Compensation Disclosures and Analysis (CD&A) section, we link our incentive pay programs to a balanced mix of measures on three dimensions of company performance: operating performance; progress with our innovation pipeline; and shareholder return.

The summary information below highlights how our incentive pay programs align with company performance. Please also see Appendix A for adjustments that were made to revenue and EPS for incentive compensation programs.

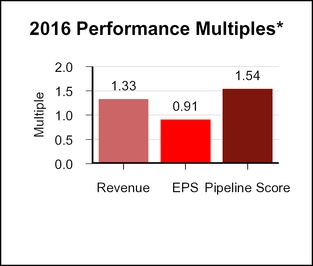

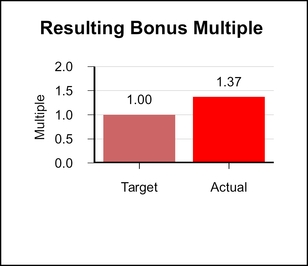

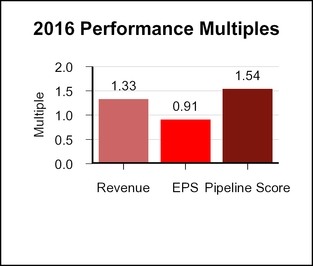

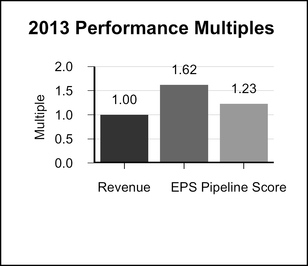

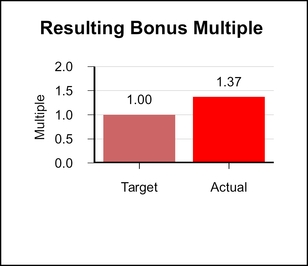

2016 Annual Cash Bonus Multiple

The company exceeded its annual cash bonus targets for revenue and pipeline progress, but narrowly missed its EPS target.

*Performance goal multiples are capped at 2.0.

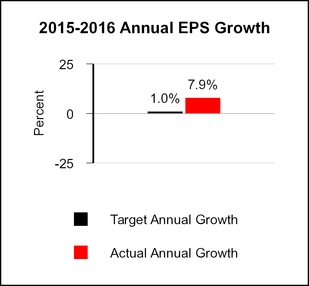

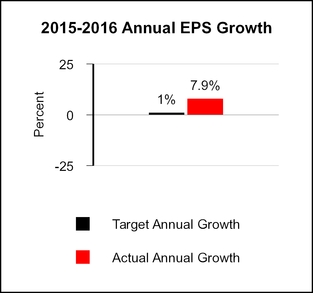

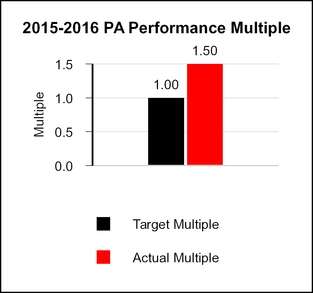

2016 Performance Award Multiple

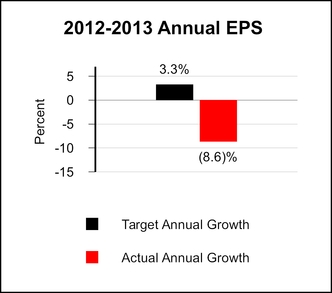

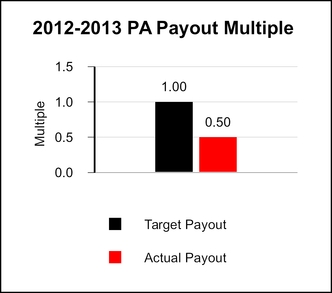

We exceeded our EPS growth targets under our Performance Award program, which has targets based on expected EPS growth of peer companies over a two-year period. This performance resulted in a Performance Award multiple in excess of the target.

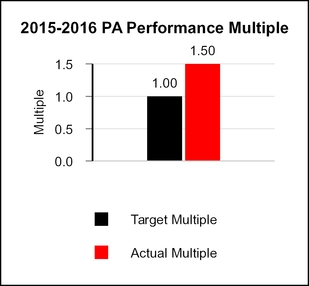

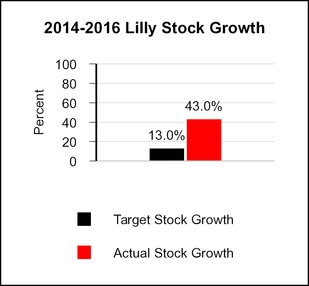

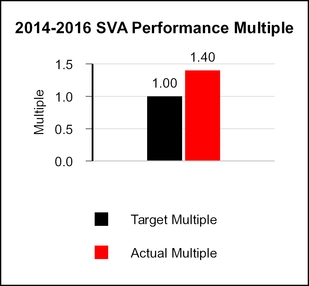

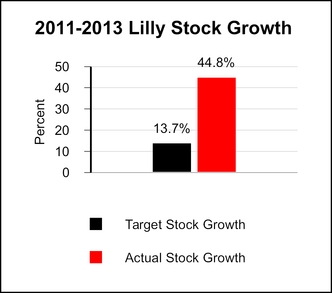

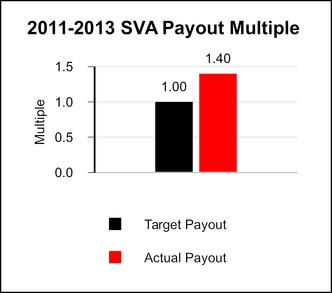

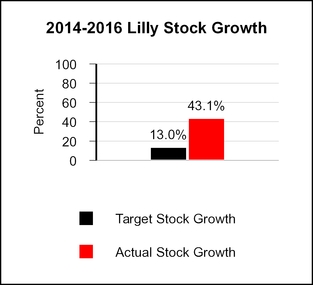

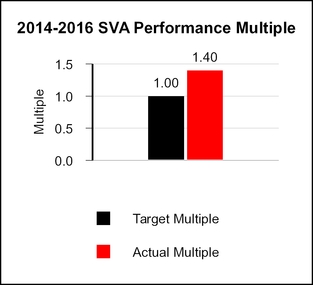

2016 Shareholder Value Award Multiple

We significantly exceeded our stock price growth targets under our Shareholder Value Award program, which has targets based on expected large-cap company returns over a three-year period. This performance resulted in a Shareholder Value Award multiple in excess of the target.

|

| |

Item 3: Advisory Vote Regarding Frequency of Named Executive Officer Compensation | Further Information |

| See page 59 |

|

| | | | | | |

| | | | | Management recommendation | Vote required to pass

|

| Item 3 | Advisory vote regarding the frequency of future advisory votes on executive compensation | Annual Advisory Votes | Option receiving the highest number of votes cast |

|

| |

| Audit Matters | Further Information |

Item 4: Ratification of Appointment of Principal Independent Auditor | See page 59 |

|

| | | | | | |

| | | | | Management recommendation | Vote required to pass

|

| Item 4 | Ratify the appointment of Ernst & Young LLP as the company's principal independent auditor for 2017

| Vote FOR | Majority of

votes cast |

|

| |

| Lilly Directors' Deferral Plan | Further Information |

Item 5: Amendment of the Lilly Directors' Deferral Plan | See page 62 |

|

| | | | | | |

| | | | | Management recommendation | Vote required to pass

|

| Item 5 | Approve the amendment of Lilly's Directors' Deferral Plan | Vote FOR | Majority of

votes cast |

The Lilly Directors’ Deferral Plan (the “plan”) provides an ownership position in the company that aligns directors with shareholder interests.

Under the plan, a portion of directors' annual compensation is awarded in deferred shares:

| |

| ü | all shares must be held until the second January following the director's departure from board service |

| |

| ü | no stock options can be issued under the plan. |

Changes to the plan include:

| |

| ü | authorizing an additional 750,000 shares (the same amount approved in 2003) |

| |

| ü | an annual compensation cap of $800,000 for non-employee directors. |

|

| |

| Shareholder Proposals | Further Information |

Item 6: Shareholder proposal seeking report regarding direct and indirect political contributions | See page 64 |

|

| | | | | | |

| | | | | Management recommendation | Vote required to pass

|

| Item 6 | Proposal seeking report regarding direct and indirect political contributions | Vote AGAINST | Majority of

votes cast |

|

| |

| Other Information | Further Information |

| See page 66 |

How to Vote in Advance of the Meeting

Even if you plan to attend the 20142017 Annual Meeting in person, we encourage you to vote prior to the meeting via one of the methods described below. You can vote in advance via one of three ways:

8 Visit the website listed on your proxy card/voting instruction form to vote VIA THE INTERNET

) Call the telephone number on your proxy card/voting instruction form to vote BY TELEPHONE

* Sign, date, and return your proxy card/voting instruction form to vote BY MAIL

Further information on how to vote is provided at the end of the proxy statement under "Meeting and Voting Logistics".Logistics."

Voting at our 20142017 Annual Meeting

You may also opt to vote in person at the 20142017 Annual Meeting, which will be held on Monday, May 5, 20141, 2017, at the Lilly Corporate Center, Indianapolis, IN 46285, at 11:00 a.m., local time. See the section entitledtitled "Meeting and Voting Logistics" for more information.

Governance

Item 1. Election of Directors

Under the company’s articles of incorporation, the board is divided into three classes with approximately one-third of the directors standing for election each year. The term for directors to be elected this year will expire at the annual meeting of shareholders held in 2020. Each of the nominees listed below has agreed to serve that term, with the exception of John C. Lechleiter, who will retire from the board on May 31, 2017. At that time, the board expects to reduce its size. The following sections provide information about our directors, including their qualifications, the director nomination process, and director compensation.

Board Recommendation on Item 1

The Board recommends that you vote FOR each of the following nominees:

Michael L. Eskew

William G. Kaelin, Jr., M.D.

John C. Lechleiter, Ph.D.

David A. Ricks

Marschall S. Runge, M.D., Ph.D.

Board Operations and Governance

Board of Directors

In order of appearance, from left to right: Michael L. Eskew, Katherine Baicker, Alfred G. Gilman, Karen N. Horn, Jackson P. Tai, Franklyn G. Prendergast, J. Erik Fyrwald, R. David Hoover, John C. Lechleiter, Douglas R. Oberhelman, Ellen R. Marram, Sir Winfried Bischoff, William G. Kaelin, Jr., Marschall S. Runge, Kathi P. Seifert, Ralph Alvarez.

Each of our directors is elected to serve until his or her successor is duly elected and qualified. If a nominee is unavailable for election, proxy holders may vote for another nominee proposed by the Board of Directors or, as an alternative, the Board of Directors may reduce the number of directors to be elected at the annual meeting. Each nominee has agreed to serve on the Board of Directors if elected.

Director Biographies

Set forth below is the information as of March 12, 2014,8, 2017, regarding the nominees for election, which has been confirmed by each of them for inclusion in this proxy statement. We have provided the most significant experiences, qualifications, attributes, or skills that led to the conclusion that each director or director nominee should serve as one of our directors in light of our business and structure. Full biographies for each of our directors are available on our website at http://www.lilly.com/about/board-of-directors/Pages/board-of-directors.aspx.

No family relationship exists among any of our directors, director nominees, or executive officers.EOs. To the best of our knowledge, there are no pending material legal proceedings in which any of our directors or nominees for director, or any of their associates, is a party adverse to us or any of our affiliates, or has a material interest adverse to us or any of our affiliates. See the "Other Matters" section of the proxy for information about shareholder derivative litigation in which certain directors are named as defendants. Additionally, to the best of our knowledge, there have been no events under any bankruptcy act, no criminal proceedings and no judgments, sanctions, or injunctions during the past 10 years that are material to the evaluation of the ability or integrity of any of our directors or nominees for director. There is no arrangement between any director during the past 10 years.or director nominee and any other person pursuant to which he or she was or is to be selected as a director or director nominee.

Class of 20142017

The following six directors’ termsfive directors will expirebe seeking election at this year’syear's annual meeting. Four of these directors are standing for reelection; David A. Ricks is seeking election for the first time. Dr. GilmanLechleiter will retire from the Board atboard on May 31, 2017. At that time, the end of his term. The other five directors are standing for reelection.board expects to reduce its size. See “Item 1. Election of Directors” belowabove for more information.

Michael L. Eskew, age 64, director since 2008P10

|

| | | | |

| | Michael L. Eskew Age: 67, Director since 2008 Board Committees:Committees: Audit (chair); Directors and Corporate Governance; Finance |

Career Highlights | Other Board Service |

United Parcel Service, Inc. | • | Public boardsBoards: 3M Corporation; IBM CorporationCorporation; Allstate Insurance Company |

• | Former Chairman and Chief Executive Officer (2002 - 2007) | • | Non-profit serviceNonprofit Boards: Chairman of the board of trustees of The Annie E. Casey Foundation

|

• | |

| |

| | |

| Career Highlights | | United Parcel Service, Inc., a global shipping and logistics company |

| | • Chairman and Chief Executive Officer (2002 - 2007) |

| | • Vice Chairman (2000 - 2002) |

| | • UPS Board of Directors (1998 - present)2014) |

• | Vice Chairman (2000 - 2002) | | |

Qualifications: Mr. Eskew has CEO experience with UPS, where he established a record of success in managing complex worldwide operations, strategic planning, and building a strong consumer-brand focus. He is an Audit Committeeaudit committee financial expert, based on his CEO experience and his service on other U.S. company audit committees. He has extensive corporate governance experience through his service on the boards of other companies. |

Alfred G. Gilman, M.D., Ph.D., age 72, director since 1995

|

| | | | |

| | William G. Kaelin, Jr., M.D. Age: 59, Director since 2012 Board Committees:Committees Public Policy and Compliance;: Finance, Science and Technology (chair) |

Career Highlights | Career Honors |

University of Texas Southwestern Medical Center | • | Nobel Prize in Physiology or Medicine (1994) |

• | Regental Professor Emeritus (2009 - present) | • | Nadine and Tom Craddick Distinguished Chair in Medical Science |

• | Executive Vice President for Academic Affairs and Provost (2006 - 2009) | • | Raymond and Ellen Willie Distinguished Chair of Molecular Neuropharmacology |

• | Dean of the Medical School (2004 - 2009) | Other Board Service |

Cancer Prevention and Research Institute of Texas | • | Public board: Regeneron Pharmaceuticals, Inc.

|

• | Chief Scientific Officer (2009 - 2012) |

Qualifications: Dr. Gilman is a Nobel Prize-winning pharmacologist, researcher, and professor. He has deep expertise in basic science, including mechanisms of drug action, and experience with pharmaceutical discovery research. As the former dean of a major medical school, he brings to the Board important perspectives of both the academic and practicing medical communities.

|

Karen N. Horn, Ph.D., Age 70, Director since 1987

|

| | | |

Board Committees: Compensation (chair); Directors and Corporate Governance

|

Career Highlights | Other Board Service |

Brock Capital Group, a provider of financial advising and consulting services

| • | Public boards: T. Rowe Price Mutual Funds; Simon Property Group, Inc.; and Norfolk Southern Corporation

|

• | Senior Managing Director (2004 - present) |

Marsh, Inc., a global provider of risk and insurance services

| • | Prior public board service: Fannie Mae; Georgia-Pacific Corporation

|

• | President, Private Client Services and Managing Director (1999 - 2003) | |

Bank One, Cleveland, N.A. | | |

• | Chairman and chief executive officer (1982 - 1987) | | |

QualificationsIndustry Memberships: Ms. Horn is a former CEO with extensive experience in various segments of the financial industry, including banking and financial services. Through her for-profit and her public-private partnership work, she has significant experience in international economics and finance. Ms. Horn has extensive corporate governance experience through service on other public company boards in a variety of industries.

|

William G. Kaelin, Jr., M.D.,age 56, director since 2012

|

| | | |

Board Committees: Finance; Science and Technology

|

Career Highlights | Industry Memberships |

Dana-Farber/Harvard Cancer Center | • | Institute of Medicine; National Academy of Sciences; Association of American PhysiciansPhysicians; American Society of Clinical Investigation |

• | |

| Honors: Canada Gairdner International Award; Lefoulon-Delalande Prize - Institute of France; Albert B. Lasker Prize |

| |

| | |

| Career Highlights | | Dana-Farber/Harvard Cancer Center

|

| | • Professor of Medicine (2002 - present) |

• | Associate director, Basic Science (2009 - present) | Career Honors |

| | • | Canada Gairdner International AwardBrigham and Women's Hospital |

| | | • Professor (2002 - present) |

| Lefoulon-Delalande Prize | Howard Hughes Medical Institute |

| | • Investigator (2002 - Institute of Francepresent) |

| | • Assistant Investigator (1998 - 2002) |

|

Qualifications: Dr. Kaelin is a prominent medical researcher and academician. He has extensive experience at Harvard Medical School, a major medical institution, as well as special expertise in oncology—a key component of Lilly's business. He also has deep expertise in basic science, including mechanisms of drug action, and experience with pharmaceutical discovery research. |

John C. Lechleiter, Ph.D., age 60, director since 2005

|

| | | | |

| | John C. Lechleiter, Ph.D. Age: 63, Director since 2009 Board Committees:Committees: none |

Industry Memberships | |

Career Highlights | • | Industry Memberships: American Chemical Society; Pharmaceutical Research and Manufacturers of America; Business Roundtable; President of International Federation of Pharmaceutical Manufacturers & Associations; Chairman of the U.S. - Japan Business CouncilSociety |

Eli Lilly and Company | |

• | President and CEO (2008 - present) |

• | Chairman of the Board (2009 - present) |

Career Honors | Other Board Service |

• | Honorary doctorates:Degrees: Marian University, University of Indianapolis, the National University of Ireland, and Indiana University, Franklin College, and Purdue University

|

| • |

| | Public boardsBoards: Ford Motor Company; Nike, Inc. |

| | • | Non-profit boardsBoards: United Way Worldwide; Xavier University; the Life SciencesWorldwide, chairman; Chemical Heritage Foundation; and the Central Indiana Corporate Partnership (member emeritus) |

| | |

| Career Highlights | | Eli Lilly and Company

|

| | • Chairman of the Board (2009 - present) |

| | • Past President and CEO (2008 - 2016) |

|

Qualifications: Dr. Lechleiter is our chairman, president, and chief executive officer. A Ph.D. chemist by training,serves as Lilly's non-executive chairman. He will retire from the board on May 31, 2017. Dr. Lechleiter hasserved as President and CEO from April 1, 2008 until his retirement on December 31, 2016. Prior to his retirement, Dr. Lechleiter had over 3037 years of experience with the company in a variety of roles of increasing responsibility in research and development, sales and marketing,pharmaceutical operations, and corporate administration. As a result, he has a deepsound understanding of pharmaceutical research and development, sales and marketing, strategy, and operations.manufacturing. He also has significant corporate governance experience through his service on other public company boards.

|

Marschall S. Runge, M.D., Ph.D., age 59, director since 2013. Dr. Runge is serving under interim election by the board and was referred to the Directors and Corporate Governance Committee by an independent executive search firm.

|

| | | | |

| | David A. Ricks Age: 49, Director since 2017 Board Committees: CommitteesScience: none |

| |

| Industry Memberships: European Federation of Pharmaceutical Industries and Technology; Public PolicyAssociations (EFPIA); Pharmaceutical Research and ComplianceManufacturers of America (PhRMA) |

| |

| Non-profit Boards: Board of Governors for Riley Children's Foundation |

| |

| | |

| Career Highlights | Industry Memberships | Eli Lilly and Company |

University | | • President and CEO (2017 - present) |

| | • Senior Vice President and President, Lilly Bio-Medicines (2012 - 2016) |

|

Qualifications: Mr. Ricks was named President and CEO on January 1, 2017, and became a director at that time. He will be named Chairman on June 1, 2017. Mr. Ricks joined Lilly in 1996 and most recently served as president of North Carolina, School of MedicineLilly Bio-Medicines. He has deep expertise in product development, global sales and marketing, as well as public policy. He has significant global experience in the company's commercial operations. |

|

| • | | | |

| | Marschall S. Runge, M.D., Ph.D. Age: 62, Director since: 2013 Board Committees: Public Policy and Compliance; Science and Technology

|

| |

| Industry Memberships: Experimental Cardiovascular Sciences Study Section of the National Institutes of Health |

• | |

| |

| |

| | |

| Career Highlights | | University of Michigan |

| | • CEO, Michigan Medicine (2015 - present) |

| | • Executive Vice President for Medical Affairs (2015 - present) |

| | • Dean, Medical School (2015 - present) |

| | University of North Carolina, School of Medicine |

| | • Executive Dean (2010 - present)2015); Chair of the Department of Medicine (2000 - present)2015) |

• | | • Principal Investigator and Director of the North Carolina Translational and Clinical Sciences Institute | |

| |

Qualifications: Dr. Runge brings the unique perspective of a practicing physician who has a broad background in health care, clinical research, and academia. He has extensive experience as a practicing cardiologist, a strong understanding of health care facility systems, and has deep expertise in biomedical research and clinical trial design.

|

Class of 20152018

The following fivefour directors will continue in office until 2015.

Katherine Baicker, Ph.D., age 42, director since 2011May 2018.

|

| | | | |

| | Katherine Baicker, Ph.D. Age: 45, Director since: 2011 Board Committees:Audit; Public Policy and Compliance

|

| |

| Industry Memberships: Commissioner of the Medicare Payment Advisory Commission; Chair of the Group Insurance Commission of Massachusetts; Panel of Health Advisers to the Congressional Budget Office; Editorial boards of Health Affairs and the Journal of Health Economics; and Member of the National Academy of Medicine |

| |

| |

| |

| | |

| Career Highlights | Industry Memberships |

Harvard UniversityT.H. Chan School of Public Health, Department of Health Policy and Management | • | Commissioner of the Medicare Payment Advisory Commission

|

• | | • Professor of health economics (2007 - present) |

| | • | Panel C. Boyden Gray Professor and Acting Chair, Department of Health Advisers to the Congressional Budget OfficePolicy and Management (2014 - present) |

| | Council of Economic Advisers, Executive Office of the President | • | Editorial boards of Health Affairs; the Journal of Health Economics; Journal of Economic Perspectives

|

• | | • Member (2005 - 2007) |

| |

| • | Senior Economist (2001 - 2002) |

• | Member of the Institute of Medicine |

Qualifications: Dr. Baicker is a leading researcher in the fields of health economics, public economics, and labor economics. As a valued adviser to numerous health care-related commissions and committees, her expertise in health care policy and health care delivery is recognized byin both academia and government. |

J. Erik Fyrwald, age 54, director since 2005

|

| | | | |

| | J. Erik Fyrwald Age: 57, Director since: 2005 Board Committees:Public Policy and Compliance (chair); Science and Technology

|

| |

| Non-profit Boards: UN World Food Program Farm to Market Initiative; Crop Life International; and Swiss American Chamber of Commerce |

| |

| |

| |

| | |

| Career Highlights | | E.I. duPont de Nemours and CompanySyngenta International AG, , a global chemicalSwiss-based agriculture technology company that produces agrochemicals and seeds

|

| | • Chief Executive Officer (2016 - present) |

| | Univar, Inc., a leading distributor of industrial and specialty chemicals and provider of related services |

• | | • President and Chief Executive Officer (2012 - 2016) |

| | Nalco Company, a leading provider of water treatment products and services |

| | • Chairman and Chief Executive Officer (2008 - 2011) |

| | Ecolab, a leading provider of cleaning, sanitization, and water treatment products and services |

| | • President (2012) |

| | E.I. duPont de Nemours and Company, a global chemical company

|

| | • Group Vice President, agriculture and nutrition (2003 - 2008) |

• | President and Chief Executive Officer (2012 - present) | |

Nalco Company, a provider of integrated water treatment and process improvement services, chemicals and equipment programs for industrial and institutional applications

| Other board service |

• | Non-profit boards: Society of Chemical Industry; Amsted Industries; The Chicago Public Education Fund

|

|

• | Chairman and Chief Executive Officer (2008 - 2011) | Other organizations |

| • | Field Museum of Chicago, Trustee |

Qualifications: Mr. Fyrwald has a strong record of operational and strategystrategic leadership in three complex worldwide businesses with a focus on technology and innovation. He is an engineer by training and has significant CEO experience with Syngenta, Univar, and Nalco. |

Ellen R. Marram, age 67, director since 2002, Lead director since 2012

|

| | | | |

| | Jamere Jackson Age: 47, Director since 2016 Board Committees: Audit; Finance |

| |

| Non-profit Boards: Future 5

|

| |

| |

| |

| | |

| Career Highlights | | Nielsen Holdings plc, a global information, data, and measurement company |

| | • Chief Financial Officer (2014 - present) |

| | GE |

| | • Vice President and CFO, GE Oil & Gas, drilling and surface division (2013 ‑ 2014) |

| | • Senior Executive, Finance, GE Aviation (2007 - 2013) |

| | • Finance Executive, GE Corporate (2004 - 2007) |

| | |

Qualifications: Through his senior financial roles at Nielsen and GE, Mr. Jackson brings to the board significant global financial expertise and strong background in strategic planning, having spent his professional career in a broad range of financial and strategic planning roles. He is an audit committee financial expert, based on his CFO experience and his training as a certified public accountant. |

|

| | | | |

| | Ellen R. Marram Age: 70, Director since 2002, lead director since 2012 Board Committees:Committees Compensation;: Compensation, Directors and Corporate Governance (chair) |

Career Highlights | Other Board Service |

The Barnegat Group LLC, provider of business advisory services

| • | Public boardsBoards: Ford Motor Company, The New York Times Company |

• | President (2006 - present) | • | Prior public board servicePublic Boards:Cadbury plc Private Boards: Newman's Own, Inc. |

Tropicana Beverage Group - Pepsico | • |

| Non-profit boardsBoards: Wellesley College; Institute for the Future; New York-Presbyterian Hospital; Lincoln Center Theater; and Families and Work InstituteNewman's Own Foundation |

• | |

| | |

| Career Highlights | | The Barnegat Group LLC, provider of business advisory services |

| | • President (2006 - present) |

| | North Castle Partners, LLC, private equity firm |

| | • Managing Director (2000 - 2006) |

| | Tropicana Beverage Group |

| | • President and Chief Executive Officer (1993 - 1998) |

| | Nabisco Biscuit Company, a unit of Nabisco, Inc. |

• | | • President and Chief Executive Officer (1988 - 1993) |

| | |

Qualifications: Ms. Marram is a former CEO with a strong marketing and consumer-brand background. Through her nonprofit and private company activities, she has a special focus and expertise in wellness and consumer health. Ms. Marram has extensive corporate governance experience through service on other public company boards in a variety of industries. |

Douglas R. Oberhelman, age 61, director since 2008 |

| | | |

Board Committees: Audit; Finance

|

Career Highlights | Other Board Service |

Caterpillar Inc. | • | Public boards: Caterpillar Inc.

|

• | Chairman and Chief Executive Officer (2010 - present) | • | Prior public board service: Ameren Corporation

|

• | Group President (2001 - 2010) | |

• | Chief Financial Officer (1995 - 1998) | • | Non-profit boards: Wetlands America Trust

|

Memberships and Other Organizations | |

• | Business Roundtable, Executive Committee | | |

• | Business Council | | |

• | National Association of Manufacturers, Chairman | | |

Qualifications: Mr. Oberhelman has a strong strategic and operational background as the CEO of Caterpillar, a leading manufacturing company with worldwide operations and a special focus on emerging markets. He is an audit committee financial expert as a result of his prior experience as CFO of Caterpillar and as a member and chairman of the audit committee of another U.S. public company.

|

Jackson P. Tai, age 63, director since 2013. Mr. Tai is serving under interim election by the board and was referred to the Directors and Corporate Governance Committee by an independent executive search firm. |

| | | | |

| | Jackson P. Tai Age: 66, Director since 2013 Board Committees: Committees: Audit; Finance |

| | Career Highlights | Other Board Service |

| | DBS Group Holdings and DBS Bank (formerly the Development Bank of Singapore)Public Boards:, one of the largest financial services groups in Asia

| • | Public boards: The Bank of China Limited, Singapore Airlines, MasterCard Incorporated, Royal Philips NV, HSBC Holdings plc

|

|

| • | Vice Chairman and Chief Executive Officer (2002 -2007) | • | Prior board serviceBoards: :The Bank of China Limited; Singapore Airlines; NYSE Euronext; ING Groep NV; CapitaLand (Singapore); DBS Group Holdings and DBS Bank |

| | • |

| Other (non publicly listed) Boards: Russell Reynolds Associates; Canada Pension Plan Investment Board; Metropolitan Opera; Rensselaer Polytechnic Institute |

| |

| | |

| Career Highlights | | DBS Group Holdings and DBS Bank (formerly the Development Bank of Singapore), one of the largest financial services groups in Asia

|

| | • Vice Chairman and Chief Executive Officer (2002 - 2007) |

| | • President and Chief Operating Officer (2001 - 2002) |

| | | J.P. Morgan & Co. Incorporated, a leading global financial institution |

|

| | • | 25 year• 25-year career in investment banking, including senior management responsibilities in New York, Tokyo, and San Francisco |

| | |

| Qualifications: Mr. Tai is a former CEO with extensive experience in international business and finance, and is an audit committee financial expert. He has deep expertise in the Asia-Pacific region, a key growth market for Lilly. He also has broad corporate governance experience from his service on public company boards in the U.S., Europe, and Asia. .

|

Class of 2016

2019

The following five directors are serving terms that will continueexpire in office until 2016, with the exception of Sir Winfried Bischoff, whoMay 2019. Dr. Prendergast will retire from the Boardboard on May 5, 2014, prior1, 2017. At that time, the board expects to the annual meeting of shareholders, and the Directors and Corporate Governance Committee does not plan to fill his vacant seat.reduce its size.

Ralph Alvarez, age 58, director since 2009 |

| | | | |

| | Ralph Alvarez Age: 61, Director since 2009 Board Committees: Compensation;Compensation (chair); Science and Technology |

Career Highlights | Other Board Service |

Skylark Co., Ltd., a leading restaurant operator in Japan

| • | Public boards: Lowe's Companies, Inc.; Dunkin' Brands Group, Inc.; Realogy Holdings Corp.

|

• | Executive Chairman (2013 - present) |

McDonald's Corporation | • | Private boards: Skylark Co., Ltd.

|

• | President and Chief Operating Officer (2006 - 2009) | • | Prior public board service: McDonald's Corporation; KeyCorp

|

Memberships and Other Organizations |

• | Organizations:University of Miami: President's Council; School of Business Administration Board of Overseers; International Advisory Board |

| | |

| | Public Boards: Skylark Co., Ltd.; Lowe's Companies, Inc.; Dunkin' Brands Group, Inc.; Realogy Holdings Corp. |

| Prior Public Boards: McDonald's Corporation; KeyCorp |

| | |

| Career Highlights | | Skylark Co., Ltd., a leading restaurant operator in Japan |

| | • Chairman of the Board (2013 - present) |

| | McDonald's Corporation |

| | • President and Chief Operating Officer (2006 - 2009) |

| | |

Qualifications: Through his senior executive positions at Skylark Co., Ltd. and McDonald’s Corporation, as well as with other global restaurant businesses, Mr. Alvarez has extensive experience in consumer marketing, global operations, international business, and strategic planning. His international experience includes a special focus on Japan and emerging markets. He also has extensive corporate governance experience through his service on other public company boards.

|

Sir Winfried Bischoff, age 72, directorsince 2000

|

| | | | |

| | Carolyn R. Bertozzi, Ph.D. Age: 50, Director since 2017 Board Committees: DirectorsPublic Policy and Corporate Governance; Finance (chair)Compliance; Science and Technology |

| |

| Industry Memberships and Other Organizations: American Chemical Society; American Society for Biochemistry and Molecular Biology; American Chemical Society Publications, Editor-in-Chief of ACS Central Science; Institute of Medicine; National Academy of Sciences; American Academy of Arts and Sciences |

| |

| Honors: MacArthur Genius Award; Lemelson MIT Prize; Heinrich Wieland Prize, National Academy of Sciences Award in the Chemical Sciences |

| |

| | |

| Career Highlights | Other Board Service | Stanford University |

Lloyds Banking Group plc, a leading UK-based financial institution

| | • | Public boards: The McGraw-Hill Companies, Inc.

|

• | Chairman (2009 Anne T. and Robert M. Bass Professor of Chemistry, Professor of Chemical and Systems Biology and Radiology by courtesy (2015 - present) |

Citigroup Inc. | | Howard Hughes Medical Institute |

| | • Investigator (2000 - present) |

| | University of California, Berkeley |

| | Prior board service: Citigroup Inc.; Prudential plc; Land Securities plc; Akbank T.A.S.• T.Z. and Irmgard Chu Professor of Chemistry and Professor of Molecular and Cell Biology

(1996 - 2015) |

• | Chairman (2007 - 2009) |

• | Interim Chief Executive Officer (2007) | |

• | Chairman, Citigroup Europe (2000 - 2009) | | |

Qualifications: Sir Winfried BischoffDr. Bertozzi is a prominent researcher and academician. She has a distinguished career in banking and finance, including commercial banking, corporate finance, and investment banking. He has CEOextensive experience both in Europeat Stanford University and the U.S. He is a globalist,University of Berkeley, California, two major research institutions. Her deep expertise spans the disciplines of chemistry and biology, with particular expertise in European matters butan emphasis on studies of cell surface glycosylation associated with extensive experience overseeing worldwide operations. He has broad corporate governance experience from his service on public company boards in the U.S., UK,cancer, inflammation and other Europeanbacterial infection, and Asian countries.exploiting this knowledge for development of diagnostic and therapeutic approaches. |

R. David Hoover, age 68, director since 2009

|

| | | | | |

| | | R. David Hoover Age: 71, Director since 2009 Board Committees: Finance; Public PolicyFinance (Chair); Directors and ComplianceCorporate Governance |

| | |

| | Memberships and Other Organizations:Indiana University Kelley School of Business, Dean's Council |

| | |

| | Public Boards: Ball Corporation; Edgewell Personal Care Co. |

| | Prior Public Boards: Qwest International, Inc.; Steelcase, Inc. |

| | Non-profit Boards:Children's Hospital Colorado; DePauw University |

| | |

| | |

| | | |

| Career Highlights | Other Board Service |

Ball Corporation, a provider of packaging products, aerospace and other technologies and services to commercial and governmental customers | • | Public companies: Ball Corporation; Energizer Holdings, Inc.; Steelcase, Inc.

|

| |

• | Non-profit companies: Boulder Community Hospital; Children's Hospital Colorado

|

| • | Chairman (2002 - 2013) |

• | | | • Chairman and CEO (2010 - 2011) |

| | | • President and Chief Executive Officer (2001 - 2010) |

| |

| | • | Chief Operating Officer (2000 - 2001) | • | Prior public board service: Irwin Financial Corporation; Qwest International, Inc.

|

• | | | • Chief Financial Officer (1998 - 2000) | |

Memberships and Other Organizations | | |

• | Board of Trustees of DePauw University | | |

• | Indiana University Kelley School of Business, Dean's Council |

| | | | |

| Qualifications: Mr. Hoover has extensive CEO experience at Ball Corporation, with a strong record of leadership in operations and strategy. He has deep financial expertise as a result of his experience as CEO and CFO of Ball. He also has extensive corporate governance experience through his service on other public company boards.

|

Franklyn G. Prendergast, M.D., Ph.D., age 69, director since 1995

|

| | | | | |

| | | Juan R. Luciano Age: 55, Director since 2016 Board Committees: Finance; Public Policy and Compliance |

| | |

| | Public Boards: Archer Daniels Midland Company; Wilmar |

| | Non-profit Boards:Boys and Girls Clubs of America |

| | |

| | |

| | |

| | |

| | | |

| Career Highlights | | Archer Daniels Midland Company, a global food-processing and commodities-trading company

|

|

| | | • Chairman (January 2016 - present) |

| | | • Chief Executive Officer and President (2015 - present) |

| | | • President (2014 - 2015) |

| | | • Executive Vice President and Chief Operating Officer (2011 - 2014) |

| | | The Dow Chemical Company, a multinational chemical company

|

|

| | | • Executive Vice President and President, Performance Division (2010 - 2011) |

| | | |

| Qualifications: Mr. Luciano has CEO and global business experience with Archer Daniels Midland Company, where he has established a reputation for strong result-oriented and strategic leadership, as well as many years of global leadership experience at The Dow Chemical Company. He brings to the board a strong technology and operations background, along with expertise in the food and agriculture sectors, an expanding area of focus for Lilly and its Elanco business. |

|

| | | | |

| | Franklyn G. Prendergast, M.D., Ph.D. Age: 72, Director since 1995 Board Committees: Public Policy and Compliance; Science and Technology |

Career Highlights | |

| Public Boards: Cancer Genetics Incorporated |

| |

| |

| |

| | |

| Career Highlights | | Mayo Medical School |

| | |

| • | Edmond and Marion Guggenheim Professor of Biochemistry and Molecular Biology (1986 - present)2014) |

• | | • Professor of Molecular Pharmacology and Experimental Therapeutics (1987 - present)2014) |

• | | • Mayo Clinic Center for Individualized Medicine, Director Emeritus (2006 - 2012) |

| | Mayo Clinic Cancer Center |

| | • Director Emeritus (1995 - 2006) |

| | |

Qualifications: Dr. Prendergast is a prominent medical clinician, researcher, and academician. He has extensive experience in senior-most administration at Mayo Clinic, a major medical institution, and as director of its renowned cancer center. He retired from Mayo at the end of 2014. He has special expertise in two critical areas for Lilly—oncology and personalized medicine. As a medical doctor, he brings an important practicing-physician perspective to the Board’s deliberations. |

Kathi P. Seifert, age 64, director since 1995

|

| | | | |

| | Kathi P. Seifert Age: 67, Director since 1995 Board Committees: Audit; Compensation |

| | |

| Public Boards: Investors Community Bank Private Boards: Appvion, Inc. Prior Public Boards:Albertsons; Revlon Consumer Products Co.; Supervalue Inc.; Lexmark International, Inc.

|

| |

| Non-profit Boards: Community Foundation for the Fox Valley Region; Fox Cities Building for the Arts; Fox Cities Chamber of Commerce; New North |

| |

| | |

| Career Highlights | Other Board Service |

| | Kimberly-Clark Corporation, a global consumer products company | • | Public companies: Revlon Consumer Products Corporation; Lexmark International, Inc.

|

| |

| | • | Executive Vice President (1999 - 2004) |

| |

| | Katapult, LLC, a provider of pro bono mentoring and consulting services to non-profit organizations | • | Private companies: Appvion, Inc.

|

| | • | Prior public board service: Supervalu Inc.; Appleton Papers, Inc.

|

| | • | Chairman (2004 - present) | |

| | | | • | Non-profit companies: Fox Cities Performing Arts Center; Community Foundation for the Fox Valley Region; Fox Cities Building for the Arts

|

| | | |

| | | |

| Qualifications: Ms. Seifert is a retired senior executive of Kimberly-Clark. She has strong expertise in consumer marketing and brand management, having led sales and marketing for several worldwide brands, with a special focus on consumer health. She has extensive corporate governance experience through her other board positions. |

Director Qualifications and Nomination Process

Director Qualifications

The board assesses board candidates by considering the following:

ExperienceExperience: :Our directors are responsible for overseeing the company's business consistent with their fiduciary duties. This significant responsibility requires highly skilled individuals with various qualities, attributes, and professional experience. The board is well-rounded, with a balance of relevant perspectives and experience, as illustrated in the following charts:

|

| | | | | | | | | | | | | | | |

| CEO Experience: | | 8 |

| | |

| Financial Expertise: | | 7 |

| | |

| Relevant Scientific/Academic Expertise: | | 6 |

| | | | |

| Healthcare Experience: | | 7 |

| | |

| Operational/Strategic Expertise: | | 10 |

|

| International Experience: | | 8 |

| |

| Marketing and Sales Expertise: | | 7 |

| | |

Board Tenure and Refreshment:

In 2016 and 2017, the board added three new non-employee members: Mr. Juan Luciano, Mr. Jamere Jackson, and Dr. The Board seeks independent directors who representCarolyn R. Bertozzi, as well as Mr. David A. Ricks. Also in 2016 and 2017, three members retired or will retire from the board: Ms. Karen Horn, Dr. John Lechleiter, and Dr. Frank Prendergast.

As the following chart demonstrates, our director composition also reflects a mix of experiences that will enhancetenure on the qualityboard, which provides an effective balance of historical perspective and an understanding of the Board's deliberationsevolution of our business with fresh perspectives and decisions. The Board is particularly focused on maintaining a mix of individuals with CEO, international business, medical/science, government/policy or other health care experience.insights.

|

| | | | | | | | | | | |

| 2 Years Tenure or Less: | | 4 |

| | | |

| 3-5 Years: | | 4 |

| | | |

| 6-10 Years: | | 3 |

| | | | |

| More than 10 Years: | | 5 |

| | |

Diversity: The Board considers diversity as an important factor in selecting potential Board candidates but does not have a stand-alone diversity policy. The Boardboard strives to achieve diversity in the broadest sense, including persons diverse in geography, gender, ethnicity, and experiences. Although the Boardboard does not establish specific diversity goals or have a stand-alone diversity policy, the Board'sboard's overall diversity is a significantan important consideration in the director selection and nomination process. The Directors and Corporate Governance Committee assesses the effectiveness of board diversity efforts in connection with the annual nomination process as well as in new director searches. The company's current Board includes members whose experiences cover a wide range of geographies and industries, and includes members with experience in academic research, healthcare, and governmental consulting. The company'ssixteen directors range in age from 4245 to 72, and include four women and threefive ethnically diverse members.

Character: Board members should possess the personal attributes necessary to be an effective director, including unquestioned integrity, sound judgment, independence, a collaborative spirit, and commitment to the company, our shareholders, and other constituencies.

Director Nomination Process

The Boardboard delegates the director screening process to the Directors and Corporate Governance Committee, which receives input from other Boardboard members.

Potential directors are identified from several sources, including executive search firms retained by the committee, incumbent directors, management, shareholders, and executive search firms. The committee employs the same process for evaluating all shareholder candidates, including those submitted by shareholders.

The committee employs the same process for evaluating all candidates, including those submitted by shareholders. The committee initially evaluates a candidate based on publicly available information and any additional information supplied by the party recommending the candidate. If the candidate appears to satisfy the selection criteria and the committee’s initial evaluation is favorable, the committee, assisted by management or thea search firm, gathers additional data on the candidate’s qualifications, availability, probable level of interest, and any potential conflicts of interest. If the committee’s subsequent evaluation continues to be favorable, the candidate is contacted by the Chairman of the Board and one or more of the independent directors, including the lead director, for direct discussions to determine the mutual levelslevel of interest in pursuing the candidacy. If these discussions are favorable, the committee makes a final recommendation to the board to nominate the candidate for election by the shareholders (or to select the candidate to fill a vacancy, as applicable).

Shareholder RecommendationsThe committee performs periodic assessments of the overall composition and Nominationsskills of the board in order to ensure that the board and management are actively engaged in succession planning for Director Candidates

A shareholder who wishesdirectors, and that our board reflects the appropriate viewpoints, diversity, and expertise necessary to recommendsupport our complex and evolving business. The committee, with input from all board members, also considers the contributions of the individual directors at least every three years when considering whether to nominate the director to a new three-year term. The results of these assessments inform the board's recommendations on nominations for directors at the annual meeting each year and help provide us with insight on the types of experiences, skills, and other characteristics we should be seeking for future director candidate for evaluation should forwardcandidates. Based on this assessment, the candidates name and information aboutcommittee has recommended that the candidate's qualifications to:directors in the 2017 class be elected at the 2017 annual meeting.

Chair of the Corporate Governance Committee

c/o Corporate Secretary

Lilly Corporate Center

Indianapolis, IN 46285

The candidate must meet the selection criteria described above and must be willing and expressly interested in serving on the Board.

Under Section 1.9 of the company’s bylaws, a shareholder who wishes to directly nominate a director candidate at the 2015 annual meeting (i.e., to propose a candidate for election who is not otherwise nominated by the Board through the recommendation process described above) must give the company written notice by November 24, 2014 and no earlier than September 21, 2014. The notice should be addressed to the corporate secretary at the address provided above. The notice must contain prescribed information about the candidate and about the shareholder proposing the candidate as described in more detail in Section 1.9 of the bylaws. A copy of the bylaws is available online at http://investor.lilly.com/governance.cfm. The bylaws will also be provided by mail upon request to the corporate secretary.

We have not received any shareholder nominations for board candidates for the 2014 meeting.

Communication with the Board of Directors

You may send written communications to one or more members of the Board, addressed to:

Board of Directors

Eli Lilly and Company

c/o Corporate Secretary

Lilly Corporate Center

Indianapolis, IN 46285

Director Compensation

Director compensation is reviewed and approved annually by the Board,board, on the recommendation of the Directors and Corporate Governance Committee. Directors who are employees receive no additional compensation for serving on the Board.board.

Cash Compensation

In 2013,The following table shows the company provided nonemployeeretainers and meeting fees for all non-employee directors with an annual retainer of $100,000 (payable in monthly installments). In addition, certain Board roles receive additional annual retainers:effect in 2016.

Lead director: $30,000

Committee chairs: $12,000 ($18,000 for Audit Committee chair; $15,000 for Science and Technology Committee chair)

Audit Committee/Science and Technology Committee members: $3,000 |

| | | | | | | |

| Board Retainers (annual, paid in monthly installments) | | | Committee Retainers (annual, paid in monthly installments) |

| | | | |

| Annual Board Retainer | $110,000 | | Audit Committee; Science and Technology Committee members (including the chairs) | $6,000 |

| | | | |

| Annual Retainers (in addition to annual board retainer): | | | Compensation Committee; Directors and Corporate Governance; Finance Committee; Public Policy and Compliance Committee members (including the chairs) | $3,000 |

| | Lead Director | $30,000 | | |

| | Audit Committee Chair | $18,000 | | | |

| | Science and Technology Committee Chair | $15,000 | | | |

| | Compensation Committee Chair; Directors and Corporate Governance Committee Chair; Finance Committee Chair; Public Policy and Compliance Committee Chair | $12,000 | | | |

Directors are reimbursed for customary and usual travel expenses. Directors may also receive additional cash compensation for serving on ad hoc committees that may be assembled from time-to-time.

Stock Compensation

Directors shouldare required to hold meaningful equity ownership positions in the company; accordingly, a significant portion of director compensation is in the form of deferred Lilly stock. Directors are required to hold Lilly stock, directly or through company plans, valued at not less than five times their annual cashboard retainer; new directors are allowed five years to reach this ownership level. All directors serving at least five years have satisfied these guidelines, and all other directors are making progress toward these requirements.

Nonemployee

Non-employee directors receive $145,000received $160,000 of stock compensation (but no more than 7,500 shares), deposited annually in a deferred stock account in the Lilly Directors’ Deferral Plan (as described below), payable after service onbeginning the Board has ended.second January following the director's departure from board service.

Lilly Directors’ Deferral Plan: In addition to stock compensation, the Lilly Directors' Deferral Plan allows nonemployeenon-employee directors to defer receipt of all or part of their cash compensation until after their service on the Boardboard has ended. Each director can choose to invest the fundsamounts deferred in one or both of the following two accounts:

Deferred Stock Account. This account allows the director, in effect, to invest his or her deferred cash compensation in company stock. In addition, the annual award of shares to each director as noted below is credited to this account on a pre-set annual date. The number of shares credited is calculated by dividing the $145,000 annual compensation figure by the closing stock price on that date. Funds in this account are credited as hypothetical shares of company stock based on the marketclosing stock price on pre-set monthly dates. In addition, the annual stock compensation award as described above is also credited to this account. The number of shares credited is calculated by dividing the $160,000 annual compensation figure by the closing stock at the time the compensation would otherwise have been earned.price on a pre-set annual date. Hypothetical dividends are “reinvested” in additional shares based on the market price of the stock on the date dividends are paid. Actual shares are issued or transferred after the director ends his or her service on the Board.second January following the director's departure from board service.

Deferred Compensation Account. Funds in this account earn interest each year at a rate of 120 percent of the applicable federal long-term rate, compounded monthly, as established the preceding December by the U.S. Treasury Department under Section 1274(d) of the Internal Revenue Code of 1986, as amended (the Internal Revenue Code). The aggregate amount of interest that accrued in 20132016 for the participating directors was $130,990,$124,379, at a rate of 2.853.1 percent. The rate for 20142017 is 3.922.7 percent.

Both accounts may generally only be paid in a lump sum or in annual installments for up to 10 years, beginning the second January following the director’s departure from board service. Amounts in the deferred stock account are paid in shares of company stock.

2013 DirectorSee Item 5, Amendment of the Lilly Directors' Deferral Plan, for more information regarding this plan.

2016 Compensation for Non-employee Directors

| | | Name | Fees Earned

or Paid in Cash ($) | Stock Awards ($) 1 | All Other

Compensation

and Payments ($)2 | Total ($) 3 | |

Name1 | | Fees Earned

or Paid in Cash ($) | Stock Awards ($)2 | All Other

Compensation

and Payments ($)3 | Total ($)4 |

| Mr. Alvarez | $106,000 |

| $145,000 |

| $0 |

| $251,000 |

| $124,250 | | $160,000 | | $0 | | $284,250 | |

| Dr. Baicker | $103,000 |

| $145,000 |

| $0 |

| $248,000 |

| $119,000 | | $160,000 | | $0 | | $279,000 | |

| Sir Winfried Bischoff | $112,000 |

| $145,000 |

| $10,196 | 4 | $267,196 |

| |

| Mr. Eskew | $121,000 |

| $145,000 |

| $0 |

| $266,000 |

| $140,000 | | $160,000 | | $0 | | $300,000 | |

| Mr. Fyrwald | $115,000 |

| $145,000 |

| $30,000 |

| $290,000 |

| $131,000 | | $160,000 | | $17,434 | | $308,434 | |

| Dr. Gilman | $118,000 |

| $145,000 |

| $28,576 |

| $291,576 |

| |

| Mr. Hoover | $106,000 |

| $145,000 |

| $30,000 |

| $281,000 |

| $128,000 | | $160,000 | | $30,000 | | $318,000 | |

| Ms. Horn | $112,000 |

| $145,000 |

| $5,550 |

| $262,550 |

| $53,333 | | $66,667 | | $14,050 | | $134,050 | |

| Mr. Jackson | | $29,750 | | $40,000 | | $0 | | $69,750 | |

| Dr. Kaelin | $103,000 |

| $145,000 |

| $23,700 |

| $271,700 |

| $134,000 | | $160,000 | | $20,500 | | $314,500 | |

| Mr. Luciano | | $106,333 | | $146,667 | | $0 | | $253,000 | |

| Ms. Marram | $142,000 |

| $145,000 |

| $30,000 |

| $317,000 |

| $158,000 | | $160,000 | | $30,000 | | $348,000 | |

| Mr. Oberhelman | $106,000 |

| $145,000 |

| $30,000 |

| $281,000 |

| |

| Dr. Prendergast | $103,000 |

| $145,000 |

| $0 |

| $248,000 |

| $119,000 | | $160,000 | | $0 | | $279,000 | |

| Dr. Runge | $34,333 |

| $48,333 |

| $0 |

| $82,666 |

| $123,500 | | $160,000 | | $0 | | $283,500 | |

| Ms. Seifert | $103,000 |

| $145,000 |

| $10,250 |

| $258,250 |

| $119,000 | | $160,000 | | $10,800 | | $289,800 | |

| Mr. Tai | $17,167 |

| $24,167 |

| $30,000 |

| $71,334 |

| $123,500 | | $160,000 | | $0 | | $283,500 | |

1 Carolyn R. Bertozzi, Ph.D., is not included in this chart as she became a board member effective February 2017.

2 Each non-employee director received an award of stock valued at $160,000 (approximately 2,088 shares), except Ms. Horn, who retired from the board in May 2016; Mr. Luciano, who joined the board in

February 2016; and Mr. Jackson, who joined the board in October 2016. All received a pro-rated award for a partial year of service. This stock award and all prior stock awards are fully vested; however, the shares are not issued until the second January following the director's departure from board service, as described above under “Lilly Directors’ Deferral Plan.” The column shows the grant date fair value for each director’s stock award. Aggregate outstanding stock awards are shown in the “Common Stock Ownership by Directors and Executive Officers” table in the “Stock Units Not Distributable Within 60 Days” column.

| |

1

| Each nonemployee director received an award of stock valued at $145,000 (approximately 2,841 shares), except Dr. Runge and Mr. Tai, who received shares proportionately for a partial year of service. This stock award and all prior stock awards are fully vested in that they are not subject to forfeiture; however, the shares are not issued until the director ends his or her service on the Board, as described above under “Lilly Directors’ Deferral Plan.” The column shows the grant date fair value for each director’s stock award. Aggregate outstanding stock awards are shown in the “Common Stock Ownership by Directors and Executive Officers” table in the “Stock Units Not Distributable Within 60 Days” column. Aggregate outstanding stock options as of December 31, 2013 are shown in the table below. These options, which were granted in 2004, expired in February 2014 with no value. |

|

| | |

| Name | Outstanding Stock Options (Exercisable) | Exercise Price |

| Sir Winfried Bischoff | 2,800 | $73.11 |

| Dr. Gilman | 2,800 | $73.11 |

| Ms. Horn | 2,800 | $73.11 |

| Ms. Marram | 2,800 | $73.11 |

| Dr. Prendergast | 2,800 | $73.11 |

| Ms. Seifert | 2,800 | $73.11 |

| |

23